In the world of finance, understanding the various metrics and calculations is essential for making informed investment decisions. One of the most commonly used metrics is the Compound Annual Growth Rate, or CAGR. This metric is particularly useful for evaluating the performance of investments over time, as it provides a smoothed annual rate that represents the consistent rate of return. In this article, we will explore what CAGR is, how it is calculated, its significance in finance, and how it can be used by investors and analysts.

Understanding CAGR

CAGR stands for Compound Annual Growth Rate. It is a measure that is used to describe the growth of an investment or a business over a specified period of time, assuming that the investment has grown at a steady rate on an annually compounded basis. Unlike simple annual growth rates, which can be volatile and subject to year-to-year fluctuations, CAGR provides a more stable and averaged growth rate over time.

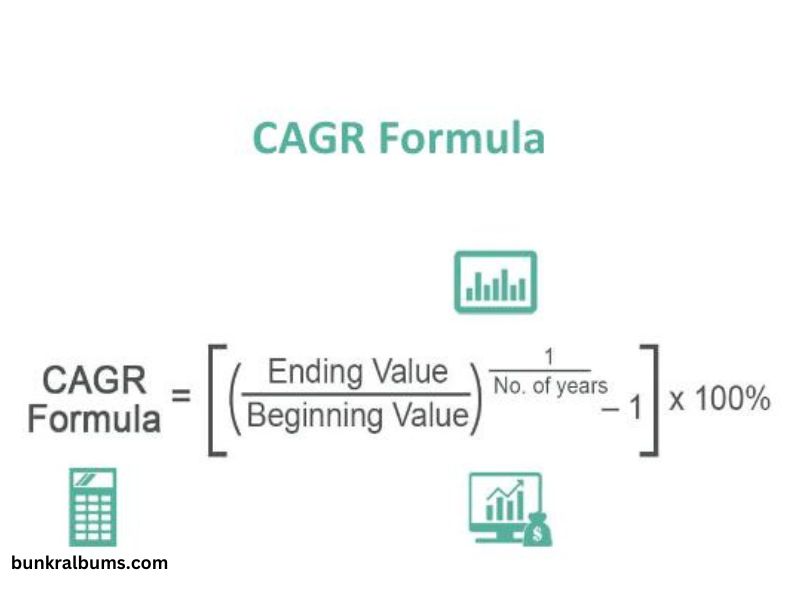

The formula for calculating CAGR is as follows:

CAGR=(Ending ValueBeginning Value)1n−1CAGR = \left(\frac{Ending\ Value}{Beginning\ Value}\right)^{\frac{1}{n}} – 1

Where:

- Ending Value is the value of the investment at the end of the period.

- Beginning Value is the value of the investment at the start of the period.

- n is the number of years over which the growth is being measured.

How to Calculate CAGR

Let’s walk through an example to illustrate how CAGR is calculated.

Suppose you invested $10,000 in a stock five years ago, and today that investment is worth $16,000. To calculate the CAGR for this investment, you would use the formula:

CAGR=(16,00010,000)15−1CAGR = \left(\frac{16,000}{10,000}\right)^{\frac{1}{5}} – 1

First, divide the ending value by the beginning value:

16,00010,000=1.6\frac{16,000}{10,000} = 1.6

Next, take the 5th root of 1.6 (since the investment period is five years):

1.615≈1.09851.6^{\frac{1}{5}} \approx 1.0985

Finally, subtract 1 from the result:

1.0985−1=0.0985 or 9.85%1.0985 – 1 = 0.0985 \text{ or } 9.85\%

So, the CAGR of your investment is 9.85%. This means that your investment grew at an average annual rate of 9.85% over the five-year period.

Significance of CAGR in Finance

CAGR is a vital tool in finance because it provides a single growth rate that investors can use to compare different investments, regardless of the time period or the volatility of returns. Here are some of the reasons why CAGR is significant:

- Smoothing Volatility: One of the key advantages of CAGR is that it smooths out the volatility of investment returns. Many investments experience fluctuating returns, with some years seeing significant gains and others experiencing losses. CAGR averages these returns to provide a single, stable growth rate, making it easier to compare investments.

- Comparing Investments: Investors often use CAGR to compare the historical performance of different investments. For instance, if you are comparing the performance of two stocks over the last ten years, CAGR can provide a clear indication of which stock has grown at a higher rate on an annualized basis.

- Goal Setting and Forecasting: CAGR is also used by financial planners and investors to set future investment goals. By knowing the CAGR of a particular investment, you can estimate how much it might grow in the future if it continues to perform at the same rate. This can be useful for retirement planning, educational savings, and other long-term financial goals.

- Understanding Business Growth: Businesses and analysts use CAGR to evaluate the growth of revenue, profits, customer base, and other key metrics over time. This helps in understanding the company’s performance and potential for future growth. For instance, a company that has a CAGR of 15% in revenue over the last five years is likely growing rapidly, which might make it an attractive investment opportunity.

- Benchmarking: CAGR is also used as a benchmarking tool. For example, a company might compare its revenue growth CAGR to the industry average to assess its competitive standing. If the company’s CAGR is higher than the industry average, it could indicate that the company is outperforming its peers.

Limitations of CAGR

While CAGR is a useful tool, it does have some limitations that investors should be aware of:

- Ignores Yearly Volatility: Although CAGR smooths out volatility, it also ignores the ups and downs that occur from year to year. For example, an investment that grows by 50% in one year and declines by 30% in the next year might have the same CAGR as an investment that grows steadily at 10% per year. However, the risk profiles of these two investments are very different, which CAGR does not capture.

- Assumes Reinvestment of Returns: CAGR assumes that all returns are reinvested at the same rate, which might not always be realistic. In the real world, investors might not reinvest dividends, interest, or capital gains, and the rate of return on reinvested funds might differ from the original investment.

- Misleading for Short Periods: CAGR can be misleading when used for short periods of time. A high CAGR over a short period might not be sustainable in the long run, and using it to make long-term projections can lead to overly optimistic expectations.

- No Information on Cash Flows: CAGR does not provide any information about cash flows during the investment period. For instance, if an investment required additional capital infusions during the period, the CAGR would not reflect this, potentially giving a distorted view of the true performance.

Practical Applications of CAGR

CAGR has numerous practical applications in finance and business. Some of the most common uses include:

- Investment Performance Analysis: Investors use CAGR to analyze the performance of their portfolios. By calculating the CAGR of their overall portfolio or individual assets, they can assess how well their investments have performed over time.

- Mutual Fund Comparisons: Mutual funds often report their performance in terms of CAGR. This allows investors to compare the growth rates of different funds over the same period, making it easier to choose the best performing fund.

- Business Growth Metrics: Companies use CAGR to track the growth of various metrics, such as revenue, earnings, and market share. This helps management and stakeholders assess the company’s growth trajectory and make informed decisions about future investments and strategies.

- Projecting Future Growth: Financial analysts use CAGR to project future growth based on historical data. By applying the CAGR to current values, they can estimate where a company or investment might be in the future, assuming the growth rate remains consistent.

- Valuation Models: CAGR is often used in valuation models to estimate future cash flows, earnings, or other financial metrics. These models rely on the assumption that past growth rates can be indicative of future performance, which makes CAGR a valuable input.

- Education Planning: For individuals planning for future education expenses, CAGR can help estimate the growth of educational savings accounts or the rate at which tuition costs are increasing. This information is crucial for setting realistic savings goals.

Conclusion

CAGR is a powerful and widely used metric in finance that provides a clear and concise way to measure the growth of an investment or business over time. By smoothing out year-to-year volatility, CAGR offers a stable and averaged growth rate, making it easier for investors to compare different investments and make informed decisions.

However, while CAGR is a valuable tool, it is important to understand its limitations and use it in conjunction with other metrics to gain a comprehensive view of an investment’s performance. When used correctly, CAGR can be an essential part of any investor’s toolkit, helping to evaluate past performance, set future goals, and make better financial decisions.