Investing in real estate can be a lucrative and rewarding venture, but it also requires careful planning, research, and execution. Whether you’re a seasoned investor or a newcomer to the world of real estate, this comprehensive guide will provide you with the knowledge and tools you need to navigate the process of real estate investment successfully.

Introduction to Real Estate Investment

Real estate investment involves the acquisition, ownership, management, and sale of land, buildings, and other types of real property for the purpose of generating income or capital appreciation. It can be a complex and multifaceted endeavor, but with the right approach, it can also be a highly profitable one.

Benefits of Investing in Real Estate

Investing in real estate offers several potential benefits, including:

- Steady Income: Rental properties can provide a reliable stream of passive income, which can be especially valuable during economic downturns.

- Appreciation: Real estate values tend to appreciate over time, allowing investors to benefit from capital gains when they sell their properties.

- Tax Advantages: Real estate investment often comes with a range of tax benefits, such as deductions for mortgage interest, property taxes, and depreciation.

- Leverage: Real estate investment allows you to leverage your capital, as you can typically finance a significant portion of the purchase price through a mortgage.

- Diversification: Adding real estate to your investment portfolio can help diversify your assets and reduce overall risk.

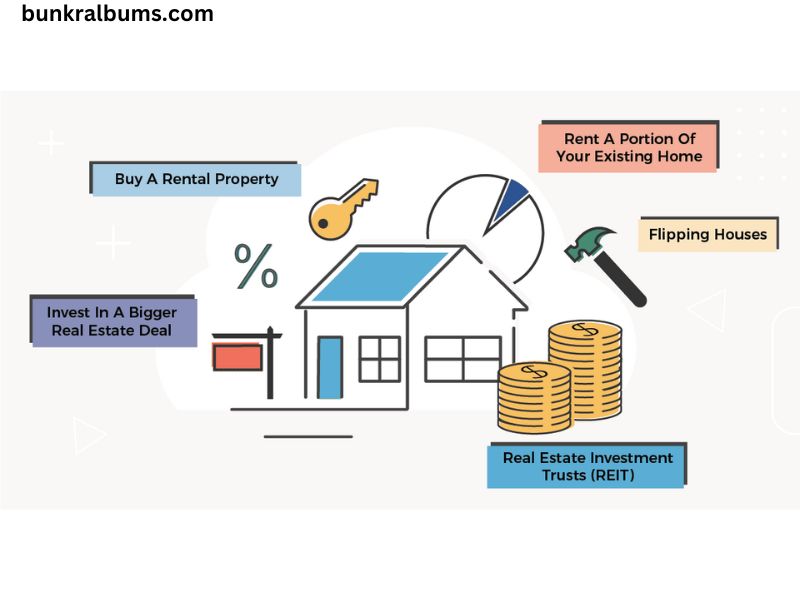

Different Types of Real Estate Investments

There are several different types of real estate investments to consider, including:

- Residential Real Estate: This includes single-family homes, duplexes, townhouses, and apartments, which can be rented out to tenants.

- Commercial Real Estate: This includes office buildings, retail spaces, warehouses, and other income-generating properties.

- Industrial Real Estate: This includes manufacturing facilities, distribution centers, and other properties used for industrial purposes.

- Land: This includes undeveloped land, which can be held for future development or investment.

- Real Estate Investment Trusts (REITs): These are publicly traded companies that own and operate income-producing real estate, allowing investors to gain exposure to the real estate market without directly owning property.

Steps to Get Started in Real Estate Investment

If you’re interested in investing in real estate, here are the key steps to get started:

- Researching the Real Estate Market: Familiarize yourself with the local real estate market, including current trends, property values, and rental rates.

- Financing Options for Real Estate Investment: Explore various financing options, such as traditional mortgages, hard money loans, and private lenders.

- Finding the Right Property to Invest In: Identify properties that align with your investment goals and budget, and carefully evaluate their potential for appreciation and cash flow.

- Evaluating the Investment Potential of a Property: Analyze factors such as location, condition, rental demand, and potential for value-added improvements.

- Managing and Maintaining Your Real Estate Investment: Develop a plan for managing the property, including tenant selection, maintenance, and financial record-keeping.

Researching the Real Estate Market

Conducting thorough research on the real estate market is a crucial first step in your investment journey. This involves analyzing factors such as:

- Market Trends: Stay up-to-date on current and projected market conditions, including changes in property values, rental rates, and demand.

- Demographic Shifts: Understand the demographics of the area, including population growth, income levels, and employment trends, as these can impact the demand for real estate.

- Competitive Landscape: Identify and analyze the competition, including other rental properties, new developments, and potential future supply.

- Regulatory Environment: Be aware of any local zoning laws, building codes, or other regulations that may impact your investment.

Financing Options for Real Estate Investment

Securing the right financing is essential for successful real estate investment. Some of the most common financing options include:

- Traditional Mortgages: Conventional mortgage loans from banks, credit unions, or other lenders, which typically require a down payment of 20% or more.

- Hard Money Loans: Short-term, asset-based loans that are often used for fix-and-flip or other short-term real estate projects.

- Private Lenders: Individuals or investment groups that provide financing for real estate investments, often with more flexible terms than traditional lenders.

- Real Estate Investment Loans: Specialized loans designed specifically for real estate investors, which may offer higher loan-to-value ratios and more favorable terms.

Finding the Right Property to Invest In

Identifying the right property to invest in is crucial for the success of your real estate investment. When evaluating potential properties, consider factors such as:

- Location: The property’s location, including factors like proximity to amenities, transportation, and job centers, can significantly impact its value and rental demand.

- Property Condition: Assess the property’s condition and any necessary repairs or renovations, as these can impact the overall investment cost and potential returns.

- Rental Demand: Analyze the rental market in the area, including current rental rates, vacancy rates, and the demand for the type of property you’re considering.

- Potential for Value-Added Improvements: Look for properties that offer opportunities to add value through renovations, upgrades, or other improvements.

Evaluating the Investment Potential of a Property

Once you’ve identified a potential investment property, it’s important to thoroughly evaluate its investment potential. This includes analyzing factors such as:

- Cash Flow: Estimate the property’s potential rental income and operating expenses to determine its net cash flow.

- Capitalization Rate: Calculate the property’s capitalization rate, which is a measure of the property’s potential return on investment.

- Appreciation Potential: Assess the property’s potential for capital appreciation based on factors like location, market trends, and planned developments.

- Risk and Mitigation Strategies: Identify potential risks and develop strategies to mitigate them, such as diversifying your portfolio or maintaining a cash reserve.

Managing and Maintaining Your Real Estate Investment

Effective property management is crucial for the long-term success of your real estate investment. This includes:

- Tenant Selection and Management: Carefully screen and select tenants, and develop a plan for managing tenant relationships and addressing any issues that may arise.

- Maintenance and Repairs: Establish a regular maintenance schedule and budget for repairs to ensure the property remains in good condition.

- Financial Record-Keeping: Maintain detailed financial records, including rental income, expenses, and any capital improvements, to track the property’s performance and prepare for tax filings.

- Risk Management: Implement strategies to mitigate risks, such as securing appropriate insurance coverage and developing contingency plans for unexpected events.

Real Estate Investment Strategies

There are several different real estate investment strategies to consider, including:

- Buy-and-Hold: Purchasing a property with the intention of holding it long-term and generating rental income.

- Fix-and-Flip: Buying a property, making necessary renovations or improvements, and then selling it for a profit.

- Real Estate Investment Trusts (REITs): Investing in publicly traded companies that own and operate income-producing real estate.

- Real Estate Crowdfunding: Investing in real estate projects through online platforms that pool funds from multiple investors.

Risks and Challenges in Real Estate Investment

While real estate investment can be a lucrative endeavor, it also comes with its fair share of risks and challenges, including:

- Market Fluctuations: Real estate values can be subject to market fluctuations, which can impact the value of your investment.

- Tenant Turnover: Finding and retaining reliable tenants can be a significant challenge, and vacancies can impact your rental income.

- Maintenance and Repair Costs: Unexpected maintenance and repair costs can eat into your profits and require careful budgeting.

- Regulatory Changes: Changes in local zoning laws, building codes, or other regulations can impact the viability of your investment.

Tips for Successful Real Estate Investment

To increase your chances of success in real estate investment, consider the following tips:

- Develop a Comprehensive Investment Plan: Clearly define your investment goals, risk tolerance, and investment strategy.

- Diversify Your Portfolio: Invest in a mix of property types and locations to mitigate risk and enhance your overall returns.

- Stay Informed: Continuously educate yourself on market trends, industry best practices, and changes in regulations.

- Build a Strong Network: Establish relationships with real estate professionals, such as agents, property managers, and lenders, to access valuable resources and opportunities.

- Maintain Discipline: Stick to your investment plan and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

Investing in real estate can be a rewarding and lucrative endeavor, but it also requires careful planning, research, and execution. By understanding the benefits, risks, and strategies involved in real estate investment, you can position yourself for long-term success. Remember to stay informed, diversify your portfolio, and seek the guidance of experienced professionals to navigate the complexities of the real estate market.

If you’re ready to take the next step in your real estate investment journey, consider signing up for our comprehensive real estate investment course. Our expert-led program will provide you with the knowledge and tools you need to identify, evaluate, and successfully invest in a wide range of real estate opportunities. Click here to learn more and enroll today!